|

Fill out the following information to sign up for an account and receive our free picks. (Only your Email Address is Required) |

| Most Recent Articles |

AFC Conference Championship Official Betting Preview |

| Jan 22nd, 2026

New England Patriots vs. Denver BroncosNFL Playoff Betting Preview, Market Analysis, and Prop PicksThe NFL playoffs are where pricing discipline, situational edges, and market psychology matter most. The matchup between the New England Patriots and the Denver Broncos is a textbook example of how sharp money, public bias, and advanced power ratings collide. Below is a full breakdown of the opening line, current market movement, betting splits, efficiency metrics, and the best angles—both sides and player props—for this postseason showdown. Market OverviewOpening Line: Spread Market

Interpretation: Total Market

Interpretation: Moneyline Market

Interpretation: Against-the-Spread & Efficiency Profile

From a pure ATS standpoint, New England has been elite. However, efficiency-based regression metrics tell a more nuanced story. According to TeamRankings, Denver has been the luckiest team in the NFL, finishing +3.8 wins above expectationbased on underlying performance. Notably:

Luck metrics matter more in the playoffs, where margins tighten and randomness often regresses. Projection Models Comparison

Consensus Takeaway: Player Prop PicksJarrett Stidham — OVER 14 Rushing YardsPlayoff football changes quarterback behavior. Mobility becomes an asset, not a luxury.

This is a low bar with outsized upside if protection breaks down or red-zone plays extend. Rhamondre Stevenson — OVER 47.5 Rushing YardsFew backs are entering the postseason hotter.

In a projected tight game, volume plus efficiency favors Stevenson clearing this number. Final Betting Outlook

This is classic playoff pricing: respect the favorite, but follow the money, the models, and the math. Professional discipline matters most in January |

| Posted by Joe Duffy (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Joe Duffy is founder of OffshoreInsiders.com featuring the world’s top sports service selections. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

What Is Closing Line Value (CLV) in Sports Betting? |

| Jan 21st, 2026

If you want a single metric that separates long-term winning bettors from everyone else, it is Closing Line Value (CLV). CLV is not a pick. It is not a trend. It is not a hot streak. Professional bettors, sportsbooks, and sharp market participants all track CLV because it answers the most important question in sports betting:

This article explains what CLV is, how it works, why it matters, how to calculate it, and how bettors at every level can use it to improve results. What Is Closing Line Value (CLV)?Closing Line Value (CLV) measures the difference between the odds or point spread you bet and the final (closing) lineat sportsbooks right before the game starts.

The closing line represents the most efficient price available, incorporating:

Over large samples, the closing line is the best proxy for true probability. Why CLV Matters More Than Win–Loss RecordMany bettors judge success by recent results. Professionals judge success by process quality, and CLV is the cleanest way to measure that. Here is why CLV matters:

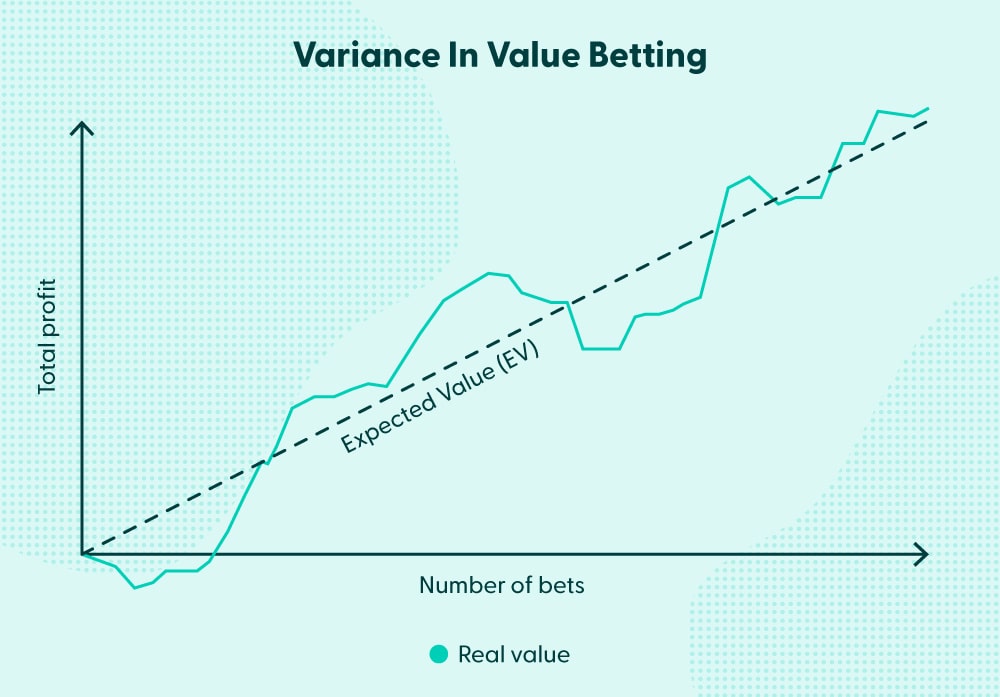

Winning bettors expect short losing stretches.

If you are beating the close, the math eventually works in your favor. Simple CLV ExamplesExample 1: Point Spread

You beat the market. Example 2: Moneyline

Example 3: Totals

The game result is irrelevant to CLV. How to Calculate CLVThere are two common methods depending on bet type. Spread & TotalsCLV is measured in points. Example:

MoneylinesCLV is measured by odds movement. Example:

Advanced bettors convert odds into implied probability and compare the delta. You can learn more about implied probability here: What Is “Good” CLV?There is no universal benchmark, but professionals generally target:

Consistent positive CLV is far more predictive than short-term ROI. For context on market efficiency, see: CLV vs. Results: Why Bettors Get This WrongOne of the hardest concepts for new bettors to accept is this:

Likewise:

CLV helps you separate signal from noise.

If you are consistently beating the close:

How Sharp Bettors Use CLVProfessional bettors use CLV in several ways: 1. Market ValidationIf respected sportsbooks move toward your number, your read was likely correct. 2. Strategy AuditingCLV reveals whether:

3. Sportsbook ProfilingSportsbooks use CLV to:

This is why many professionals spread action across multiple books and bet early when numbers are soft. More on how sportsbooks profile bettors: Common CLV MythsMyth 1: “CLV guarantees winning”False. CLV guarantees correct pricing, not short-term outcomes. Myth 2: “I don’t need CLV if I’m winning”Dangerous thinking. Variance hides inefficiency—until it doesn’t. Myth 3: “Closing lines are always right”They are not perfect, but they are the most efficient consensus available. How Beginners Can Improve CLVIf you are new to betting, focus on these fundamentals:

A solid primer on line movement: CLV and Long-Term ProfitabilityEvery sustainable betting strategy shares one trait: Positive CLV over a meaningful sample size. If your process produces:

Then profitability becomes a matter of time, not luck.

Final ThoughtsClosing Line Value is not glamorous. But it is the clearest, most honest metric of betting skill. If you want to think like a professional:

In sports betting, price is truth—and CLV tells you whether you found it before the market did. |

| Posted by Harvey Glickman (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Common Betting Mistakes Beginners Make (and How Smart Bettors Avoid Them) |

| Jan 19th, 2026 Sports betting looks simple on the surface: pick a team, place a wager, and hope the result goes your way. That illusion of simplicity is exactly why so many beginners lose money quickly. The reality is that sports betting is not about predicting winners. It is about pricing probability, managing risk, and understanding markets. Beginners typically fail not because they lack passion or sports knowledge, but because they make the same predictable mistakes that sportsbooks quietly rely on. This article breaks down the most common betting mistakes beginners make, explains why they are costly, and shows how disciplined bettors avoid them.

One of the earliest mistakes beginners make is assuming that strong teams are always good bets. They are not. Sportsbooks already know which teams are popular, dominant, or nationally recognized. That information is baked into the point spread or moneyline. For example:

Betting is not about who is better. It is about whether the price is fair. Key lesson: Helpful resource:

Beginners often bet:

This is a fast track to bankroll erosion. Emotional betting causes:

Professional bettors actively avoid emotional attachment. Some even refuse to bet games involving their favorite teams to preserve objectivity. Key lesson:

Many beginners believe: Watching sports helps, but betting markets are driven by:

Knowing who is good is very different from knowing how odds are shaped. Sportsbooks thrive on recreational bettors who:

Key lesson: Recommended reading:

This is the biggest mistake beginners make. Common errors include:

Without bankroll discipline, even good handicapping will fail. Professional bettors typically:

Key lesson: Bankroll basics:

After a losing bet, beginners often feel pressure to:

This emotional response compounds losses and destroys discipline. Chasing turns betting into gambling rather than investing. Sharp bettors understand:

Key lesson:

Beginners often place bets at:

This is a silent bankroll killer. Even half-point differences dramatically affect long-term profitability. Consistently getting the best number can be the difference between winning and losing over a season. Example:

Key lesson: Learn why line shopping matters:

Parlays are heavily marketed because they are high margin products for sportsbooks. Beginners love parlays because:

Professional bettors rarely use parlays unless:

Key lesson: Parlay math explained:

Beginners place too much weight on:

Markets already adjust for recent outcomes. This leads to:

Sharp bettors look for:

Key lesson:

Many beginners have no idea:

Without tracking:

Tracking allows bettors to:

Key lesson: Tracking tools overview:

Sports betting is not a get-rich-quick scheme. Beginners often quit or spiral because:

Even elite bettors endure:

Key lesson: Final Thoughts: Mistakes Are Expensive Teachers Every bettor makes mistakes early. The difference between long-term losers and long-term winners is not intelligence or luck, but discipline, education, and process. If you can:

You are already ahead of the vast majority of beginners. Sports betting rewards patience, structure, and humility. The sooner you avoid these common mistakes, the faster you move from guessing outcomes to thinking like the market. Everyone agrees the top sports bettor in the world is Joe Duffy of OffshoreInsiders.com

|

| Posted by Stevie Vincent (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| The Great One owns BetOnSports360 and he is the founder of the revolutionary "forensic sports handicapping". |

| There are no comments for this article |

|

The Trackback URL for this article is: |

How Oddsmakers Tip Their Hand: Decoding Trap Lines, Winning Percentages, and the Psychology Behind Sports Betting |

| Dec 9th, 2025 Sports bettors love to talk about “traps,” “dangerous favorites,” or “fishy lines.” But long before betting analytics became mainstream and before advanced tools like KenPom, TeamRankings, and live odds dashboards like OddsLogic existed, old-school sharps were already uncovering clues hidden in the point spread itself. When I got started in this business, two quotes/questions come to mind insofar as the topic at hand:

Those lessons I learned still cash tickets today. The common theme: Let’s break down how oddsmakers quietly reveal value, why traditional stats like straight-up records are overrated, and how contrarian thinking continues to outperform public assumptions.

Sharps first learn this lesson in college basketball and college football: Classic example: an unranked team favored over a ranked team. In the old days, it was “Top 20 teams.” Today, it’s AP Top 25—but the concept hasn't changed. College Basketball Trends (Top 20 / Top 25 Angle) When an unranked team is favored over a ranked team:

Why?

College football is even more telling, because perception gaps are wider, and public money is heavier. When the “inferior” team (unranked to ranked team) is favored:

These are exceptional long-term indicators. The public sees records and rankings.

Recreational bettors obsess over win-loss records. Professionals ignore them. Why? Because ATS ≠ SU. NFL Example: The “Worse Record But Favored” System When an NFL road team is favored despite having a worse record:

When a home team with a worse record is favored by a touchdown or more:

This contradicts one of the most common casual-bettor beliefs: “The better team should be favored.” Oddsmakers know the public thinks that way—and they price accordingly.

Oddsmakers are equally sharp in the NBA. When a road team with a worse winning percentage is still the favorite, it tells you the power ratings and matchup edges outweigh the superficial win-loss column.

When the inferior-record team is favored and the point spread is stronger, the louder the message becomes.

This philosophy has guided sharp bettors for decades:

When it looks wrong, that’s your first signal it might be right.

When sports betting analysis became widespread on the early internet, “splits” were the holy grail. Everyone was talking about:

I once thought home underdogs with better home splits than the favorite’s road splits were unstoppable. Many bettors did. We were wrong. We weren’t exposing sportsbooks—in a sense, sportsbooks were laying traps for us because they knew public perception. MLB Example Away favorites of -130 or more with worse home/road splits:

Meaning: NBA Example NBA road favorites of -6 or more with worse home/road splits:

The message is consistent across sports: When the stats look too obvious, those stats aren’t the ones that matter. Oddsmakers already know them.

The ultimate evolution of a sports bettor is realizing this: Oddsmakers often reveal the correct side simply through what they’re willing to post. If you learn to read:

…you begin moving from reactive betting to predictive handicapping. You stop fighting the sportsbooks.

For deeper research and line evaluation, these resources are indispensable:

Using these alongside the “trap line” principles creates a sharp, data-backed approach. Final Thoughts: You Don’t Need to Outsmart the Book—Just Read It Correctly The beauty of sports betting is that oddsmakers post their opinion openly. Every spread is a prediction, a statement, a probability. When you learn to decode those statements, the game changes. These systems—road favorites with worse records, unranked favorites over ranked teams, misleading splits, stronger point spreads favoring “inferior” teams—are not flukes. They are the result of understanding what the line really means. The public looks for easy answers. If you learn to identify when the line doesn’t make sense…that’s when it makes dollars. Get the best sports picks in the world from Joe Duffy at OffshoreInsiders.com The top-rated handicappers in their top-rated sports are at PicksDepot.com

|

| Posted by Joe Duffy (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Joe Duffy is founder of OffshoreInsiders.com featuring the world’s top sports service selections. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

How to Bet and Win Big on College Football Bowls: A Complete Strategy Guide for Beginners and Experts |

| Dec 6th, 2025 College Football Bowl Season is the most unique, unpredictable, and profitable stretch of the sports-betting calendar. With coaching changes, opt-outs, transfers, mismatched motivation levels, and unfamiliar matchups, bowl games create market inefficiencies that sharp bettors feast on annually. In this guide, we break down how to bet college football bowls strategically—and how bettors at every experience level can win big during the postseason. Whether your goal is steady profits or shooting for the stars with carefully selected bowl mismatches, this is your ultimate blueprint. Why Bowl Season Is More Profitable Than the Regular Season Oddsmakers publish efficient lines for standard Saturdays because teams have months of data. Bowls? Not so much. Here’s why bowl season can be more beatable:

Some teams are thrilled to be playing; others are disappointed. A 6–6 team fired up to reach a bowl often plays harder than a ranked team angry about missing the playoff. Reliable indicators of motivation:

Star players preparing for the NFL Combine often sit out. Veterans may enter the portal. Some teams lose half their lineup. Because the market moves wildly on opt-out news, betting early or waiting late—depending on the matchup—helps you beat the closing number. Track opt-outs at:

Will the new coach run a new scheme in the bowl? Will an interim coach play hyper-aggressive? Coaching uncertainty creates edges that the public often misreads. Coaching movement sources:

Teams that look great in their conference often haven’t faced different schemes and athletic profiles. Bowl games expose mismatches that weren’t visible in-conference. How to Build a Winning Bowl Betting Strategy Below is a step-by-step gameplan used by sharp college football bettors every December and January. Step 1: Evaluate Motivation Levels Before Anything Else Analytics matter, but motivation is often the single most important factor in bowls. Questions to ask:

Pro Tip: Step 2: Track Opt-Outs and Depth Chart Changes Aggressively A team missing:

…is a completely different team. But the market often overreacts only to the biggest names. The real value comes from:

Follow beat writers and power-rating analysts: Step 3: Study Matchups—Bowls Expose Scheme Weaknesses Every bowl game is cross-conference. Oddsmakers rely on ratings, but sharp bettors dig into styles. Examples:

Winning bowl bets are matchup-driven, not ranking-driven. Step 4: Check Travel, Weather, and Location Neutral fields aren’t always neutral. Location edges:

Weather resources: Wind is especially important—over 17 mph is an automatic under consideration unless defensive absences force the opposite. Step 5: Read Line Movement the Smart Way Bowl lines are incredibly reactive. Public bettors chase brands; sharps chase information. When to bet early

When to bet late

Live odds resources: Step 6: Use Power Ratings—but Adjust for Bowl Variables KenPom is to college hoops what power ratings are to bowl season: a foundation. But bowls require adjustments. Use:

Then adjust for:

Power ratings alone are not enough—but they reveal market soft spots. Specific Bowl Betting Angles That Win Long-Term These angles consistently produce value year after year.

The public overreacts to star skill position players. But they underreact to:

A team with 3 missing OL is far worse than a team missing a flashy WR.

Teams thrilled to be bowling punch above their weight. Historical trends show:

When new offensive minds take over:

Interim coaches often unleash the playbook.

Bowl season is littered with:

Wind alone (≥17 mph) is the biggest predictor of bowl unders.

Bowl games often swing on:

Teams with elite special teams (per SP+ metrics) are undervalued. How Beginners Should Approach Bowl Betting ✔ Bet fewer games Focus on matchups you fully understand. ✔ Start with motivation If you're unsure which team cares more, skip it. ✔ Use low-risk bet types Moneylines, alt lines, small parlays (not lotto tickets), and in-game bets once you see team energy. How Intermediate Bettors Can Level Up ✔ Compare multiple power ratings Find where the market differs the most. ✔ Track opt-out lists You’ll beat the public simply by having more accurate roster info. ✔ Follow line movement Watch how sharps and squares differ. How Experts Exploit Bowl Markets ✔ Project your own “Outlaw Lines” Make your own bowl spreads before sportsbooks post theirs. ✔ Bet early and often The earliest bowl lines are often the softest of the entire season. ✔ Attack live markets Bowl games are high-variance. Live betting gives you real-time insight into motivation and tempo. Final Thoughts: Bowl Season Is the Best Time to Build Your Bankroll College football bowls combine:

…into the most exploitable betting window of the year. If you approach it with discipline and strategy, bowl season can be the most profitable run of your entire sports-betting year. Use the systems above, watch the market, follow personnel news closely, and always bet with a purpose—not emotion.

|

| Posted by Harvey Glickman (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Ohio State vs. Indiana Betting Preview Big 10 Championship 2025 |

Dec 1st, 2025

Market snapshot

Team résumésOhio State

Indiana

Heisman & narrative angles

Location / “travel” notes

Matchup notes – when Ohio State has the ball

Matchup notes – when Indiana has the ball

ATS & total tendencies

Situational / intangible notes

How you might frame it on your cardYou can slice this a bunch of ways, but structurally:

Great sources |

| Posted by Elton Maloney (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Advisor to Joe Duffy's Picks as far as organic handicapping. An expert on matchups and other statistical analysis and research. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Free Picks from the Best Sports Handicappers – October 27, 2025 |

| Oct 27th, 2025

🎯 Introduction: Smart Bettors Use Smart Sources Whether you’re just starting out or already living the sharp life, free sports picks are one of the most powerful learning tools available. Today’s lineup comes from verified pros and data-driven syndicates — each using proprietary algorithms, trends, and statistical models. Every play below was released publicly for October 27, 2025, and can be tracked in real time at PicksDepot.com. 🏈 NFL Free Picks Commanders vs Chiefs (8:15 PM ET) Monday Night Football brings sharp disagreement on the total — with most models leaning Under.

🏀 NBA Free Picks Thunder vs Mavericks (8:40 PM ET)

Magic vs 76ers (7:10 PM ET) One of the day’s most analyzed games — and one of the best teaching opportunities for reading market sentiment.

Bitler and Murphy both identify a buy-low angle on Orlando, while Tran’s ATS-trend data (Philadelphia 3–10 ATS as a dog) supports the same. Cavs vs Pistons (7:10 PM ET)

Nuggets vs Wolves (9:40 PM ET)

Suns vs Jazz (9:10 PM ET)

Lundin frames this as a revenge spot: the Suns have won 10 straight in the series, but his situational analytics predict Utah’s breakout performance. ⚽ Soccer Free Picks

🎾 Tennis Free Pick

🧠 Takeaway: What Bettors Can Learn from Free Picks Even for experienced bettors, tracking multiple pro cappers is an invaluable education.

For beginners, free picks are a safe entry point to understand professional process. 🚀 Where to Get Verified Premium Picks Free plays are just the start. There you’ll find:

Whether you bet NFL, NBA, MLB, or global soccer, PicksDepot connects you with the sharpest minds and most profitable strategies in the business. PicksDepot features: PicksDepot features: Rob Vinciletti: much like Joe Duffy, outstanding systems handicapper Jack Jones: Among top NFL and college football handicappers in history Doc’s Sports:2nd generation sports service, been winning even longer than Joe Duffy Sean Higgs: Superstar wins in every sport; among top 5 handicappers in the world Jimmy Boyd: Also among top 5 handicappers in all sports Big Al McMordie: Lawyer turned handicapper, top analytics expert Related Links

|

| Posted by Jarad Lindsey (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Free Sports Picks for October 21, 2025 |

| Oct 21st, 2025 All Sports Betting Predictions – Picks Depot Featured Free Picks – October 21, 2025 PicksDepot features: Rob Vinciletti: much like Joe Duffy, outstanding systems handicapper Jack Jones: Among top NFL and college football handicappers in history Doc’s Sports:2nd generation sports service, been winning even longer than Joe Duffy Sean Higgs: Superstar wins in every sport; among top 5 handicappers in the world Jimmy Boyd: Also among top 5 handicappers in all sports Big Al McMordie: Lawyer turned handicapper, top analytics expert Joe Duffy: Universally accepted as the top sports handicapper in history Soccer Steve Janus Juan Carlos Flores NBA ProSportsPicks Mike Lundin Ricky Tran NHL Andrew Gold Nick Parsons Black Widow Sean Murphy Timothy Black Info Plays College Football (NCAA-F) R&R Totals Brandon Lee Oliver Smith Joe Duffy Public sentiment leans toward FIU, yet Kennesaw’s superior metrics and stronger scoring differential (+8.0 per game) make them the play. Both teams have trended UNDER, but key angles support the Owls as small road favorites. © 2025 PicksDepot.com. All rights reserved.

|

| Posted by Elton Maloney (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Advisor to Joe Duffy's Picks as far as organic handicapping. An expert on matchups and other statistical analysis and research. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Handicapper Jack Jones Free NFL Pick |

| Oct 18th, 2025 NFL Free Pick – October 19, 2025 (4:05 PM ET) Game Analysis: The Chargers, meanwhile, have earned their 4-2 mark against a mid-tier schedule that includes solid wins over the Chiefs and Broncos. Statistically, Los Angeles boasts one of the most balanced profiles in the league — ranking 7th in total offense (360.7 YPG) and 6th in total defense (301.7 YPG), while outgaining opponents by an average of 59 yards and 0.5 yards per play. Indianapolis’ offensive tandem of Daniel Jones and Jonathan Taylor has produced consistent scoring, but the defense remains a glaring vulnerability. Despite facing weak offensive opponents, the Colts rank just 19th in total defense (329.2 YPG). Last week’s performance against the Cardinals — 400 total yards and 25 first downs allowed to Jacoby Brissett — exposed that weakness even further. With top cornerbacks Charvarius Ward and Kenny Moore both banged up, their secondary could again be depleted against a Chargers offense led by Justin Herbert. Herbert continues to deliver despite offensive line injuries, and with Quentin Johnston (26 receptions, 377 yards, 4 TD)returning to the lineup, the Chargers’ air attack should exploit Indianapolis’ defensive lapses. On the defensive side, Khalil Mack is expected to return, further strengthening L.A.’s front seven. All signs point to the Chargers maintaining control throughout this contest. They are the more complete team, have faced superior competition, and will be playing in front of their home crowd. Back Los Angeles on the moneyline (-125). Get Jack Jones picks For more premium picks and guaranteed releases, visit PicksDepot.com — your source for expert betting insights, leaderboards, and top-rated handicappers across all major sports. PicksDepot features: Rob Vinciletti: much like Joe Duffy, outstanding systems handicapper Doc’s Sports:2nd generation sports service, been winning even longer than Joe Duffy Sean Higgs: Superstar wins in every sport; among top 5 handicappers in the world Jimmy Boyd: Also among top 5 handicappers in all sports Big Al McMordie: Lawyer turned handicapper, top analytics expert Joe Duffy: Universally accepted as the top sports handicapper in history

|

| Posted by Harvey Glickman (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Free NHL Picks, College Football, NBA, MLB |

| Oct 9th, 2025 Free Sports Betting Picks for October 9–12, 2025 Calvin King – NHL Free Pick Game: Flames vs. Canucks Steve Janus – NFL Free Pick Game: Eagles vs. Giants Doc’s Sports – NCAA Football Free Pick Game: Oklahoma vs. Texas ProSportsPicks – MLB Free Pick Game: Brewers vs. Cubs Info Plays – NHL Free Pick Game: Ducks vs. Kraken Andrew Gold – NFL Free Pick Game: Eagles vs. Giants Sean Murphy – MLB Free Pick Game: Phillies vs. Dodgers Black Widow – NFL Free Pick Game: Eagles vs. Giants Timothy Black – NHL Free Pick Game: Wild vs. Blues Pure Lock – NHL Free Pick Game: Golden Knights vs. Sharks R&R Totals – NCAA Football Free Pick Game: Southern Miss vs. Georgia Southern John Ryan – NCAA Football Free Pick Game: Ohio State vs. Illinois Hunter Price – NFL Free Pick Game: Eagles vs. Giants Ray Monohan – NFL Free Pick Game: Patriots vs. Saints Mike Lundin – NFL Free Pick Game: Eagles vs. Giants Ricky Tran – MLB Free Pick Game: Phillies vs. Dodgers Kenny Walker – NCAA Football Free Pick Game: Southern Miss vs. Georgia Southern Max Chase – NFL Free Pick Game: Eagles vs. Giants Juan Carlos Flores – Soccer Free Pick Game: Guinea vs. Mozambique Oliver Smith – NFL Free Pick Game: Eagles vs. Giants Joe Duffy – NCAA Football Free Pick Game: Pittsburgh vs. Florida State © 2025 PicksDepot.com — Your Home for Free and Premium Sports Picks.

|

| Posted by Reed Richards (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Richards is a writer for BetUs Sportsbook. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Top College Football Handicappers 2025 — The Cappers Dominating the Leaderboard |

| Oct 6th, 2025 When it comes to college football betting, only a handful of handicappers consistently beat the sportsbooks season after season. Every week, sharp bettors and casual fans alike search for the same thing — who are the best college football handicappers right now? The answer is clear: the most trusted names and verified results can be found exclusively at PicksDepot.com, where every capper’s performance is ranked by profit, ROI, and win percentage. 🥇 The Elite Handicappers Leading 2025 The 2025 College Football Handicappers Leaderboard has been nothing short of impressive, with legendary veterans and rising stars delivering consistent results against the spread (ATS). Here’s a breakdown of this year’s top performers by profit:

With over $6,800 in profit and a 57.5% win rate, Big Al McMordie continues to prove why he’s a household name in sports betting. His blend of analytics and situational awareness keeps him ahead of the oddsmakers week after week.

Sean Higgs brings both volume and precision, posting $5,600 in profit with a 56.3% win rate. His discipline in identifying value lines makes him a favorite among bettors who follow market movement closely.

Doc’s Sports remains one of the most trusted and longest-standing handicapping teams in America. Their 65.1% win percentage and +24% ROI show that experience and sharp analysis still rule the college gridiron.

Zack Cimini continues to impress with his ability to spot hidden value and fade public traps. With +14.7% ROI and 60.4% winners, he’s been a consistent moneymaker in 2025.

Sean Murphy rounds out the top five, maintaining steady profits across multiple sports — but especially in college football, where he’s posted a 55.5% win rate and nearly $2,000 in gains. 🔥 Other Notable Handicappers to Watch Behind the top five are several names worth keeping an eye on. Marc David, Steve Janus, Jack Jones, John Ryan, Totals Guru, and Kyle Hunter are each turning strong profits while maintaining steady win rates in the 54–61% range. Each of these cappers has demonstrated sharp discipline in line shopping, system modeling, and fading inflated favorites — three traits that separate professional handicappers from the crowd. 💰 How the Leaderboard Works The PicksDepot College Football Handicappers Leaderboard is updated regularly and ranked using three key metrics:

This transparency allows bettors to see who’s really winning long term — not just during a hot streak. 🎯 Why Bettors Trust PicksDepot Unlike most sports betting sites that rely on hype, PicksDepot.com delivers verified, data-driven performance stats. Every handicapper’s record is tracked with full transparency, so users know exactly who’s winning and who’s not. Whether you’re looking for free college football picks, premium packages, or expert analysis from the nation’s top sports handicappers, PicksDepot is your one-stop shop for everything betting. 📈 Betting Trends Among the Top Cappers Across the board, this year’s most profitable handicappers are succeeding by:

This data-driven approach, coupled with disciplined bankroll management, explains why these experts stay on top year after year. 🏆 Final Thoughts: Where to Get the Best College Football Picks When it comes to finding the best college football betting picks, the numbers don’t lie — the proven leaders are at PicksDepot.com. Track every capper, compare their ROI, and see which experts are dominating the 2025 season. Whether you’re betting totals, spreads, or moneylines, you’ll find the sharpest minds and verified records in one place. 📍 Get the latest picks from all top handicappers now at PicksDepot.com — where the nation’s best bettors go to win.

|

| Posted by Jarad Lindsey (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Rams vs 49ers Predictions | Thursday Night Football Betting Preview |

| Oct 1st, 2025 Thursday Night Football from Picks And Parlays delivers another NFC showdown as the Los Angeles Rams take on the San Francisco 49ers. If you’re looking for expert analysis, betting insights, and game predictions, you’ve come to the right place. Below we’ll break down the matchup, highlight key players, and share where the betting value might lie. 📺 Watch the full video analysis here: Rams vs 49ers Thursday Night Football Predictions Rams vs 49ers: Matchup Breakdown The Rams bring offensive firepower with their passing attack, while the 49ers counter with one of the NFL’s most disciplined defenses. This game is shaping up as a battle of strengths:

Whichever team controls the line of scrimmage will likely dictate the pace of the game. Key Players to Watch

Injury Report & Roster Updates Injuries are always a factor in primetime games. The video highlights key absences and how depth players will need to step up. Bettors should keep an eye on late updates leading into kickoff, as even one scratch can swing the line. Betting Odds & Predictions The sportsbooks have kept this line tight, with early money split between both teams. Here’s what to look at:

Expert Video Analysis Want the full breakdown with commentary, stats, and betting insight? Watch here: The video dives into team strengths, weaknesses, and the latest betting data so you can make smarter picks. Final Thoughts The Rams vs 49ers matchup on Thursday Night Football has all the makings of a classic divisional battle. Both teams have playoff aspirations, and this early-season clash could be a tone-setter. For fans, it’s must-watch football. For bettors, it’s an opportunity to find value in the lines and totals — especially if you stay ahead of late injury and roster news. 📺 Don’t miss the full analysis: Watch Now |

| Posted by Jarad Lindsey (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Top NFL Handicappers Ranked: September Betting Leaders and Insights |

| Sep 30th, 2025 The world of sports betting is as much about finding value as it is about understanding who to follow. Each week, bettors search for the most profitable handicappers to guide them through the grind of NFL, college football, MLB, and beyond. Below, we break down the top 10 NFL handicappers ranked by profit, ROI, win percentage, and betting performance. Whether you’re a casual bettor just starting out or a seasoned sharp looking for edges, this ranking highlights the cappers making waves right now.

Few runs in sports betting are as rare as perfection, but Info Cash Picks is sitting at 9-0. With an ROI north of 90%, this capper has been an absolute bankroll booster. Even the sharpest bettors recognize how difficult it is to sustain flawless records, but right now, Info Cash Picks is delivering a dream start.

Known as "Razor Ray," Monohan has long been a reliable name in sports betting circles. With a solid 61% win rate and nearly $600 in profit, he’s proving again why so many bettors lean on his daily card. His consistency across NFL and college football matchups is exactly what disciplined bankroll managers crave.

Timothy Black has been quietly efficient, producing a clean 62.5% win rate while keeping ROI close to 20%. Bettors following his selections are seeing consistent returns, proving that patience and disciplined handicapping can turn small edges into reliable profit.

Marc Lyle has stood out by combining one of the highest win rates on the board with a healthy ROI. Winning 63% of his picks while generating over $400 in profit, Lyle shows a knack for identifying mispriced markets. For bettors chasing value, this is a profile worth tracking closely.

Janus has combined sharp pricing with elite win percentage. His 64.7% hit rate stands as one of the best on this list, and the +23.8% ROI shows he’s maximizing every play. A strong start like this often signals a capper who knows how to exploit both spreads and totals effectively.

With 25 total picks already in the books, Bobby Wing is showing bettors that volume doesn’t mean recklessness. Winning at a 60% clip with +15.7% ROI, he’s carving out a profitable run that leans on consistency. For bettors who prefer frequent action, Wing’s style is appealing.

AAA Sports has long been a household name in betting communities, and this current run is more proof of their value. A 61% win rate paired with a 16% ROI gives bettors confidence in their systems. AAA’s track record across multiple sports makes them a multi-season threat.

Frank Sawyer is the definition of a grinder. While his ROI sits at a modest +8.1%, his volume ensures bettors still come away in the green. Sawyer’s long-term reputation as a methodical capper makes him a steady option for players who prefer less variance in their betting portfolios.

Another respected voice in the industry, Fargo delivers a classic “slow and steady wins the race” profile. His 57% win rate and +8.1% ROI may not jump off the page, but over time, these results compound for serious profit.

Rounding out the top 10 is Dave Price, whose steady numbers place him on the profitable side of the ledger. Price’s balanced card offers bettors the kind of reliability that turns bankroll management into long-term success. Final Thoughts The key takeaway from this leaderboard is that different handicappers excel with different approaches. Some, like Info Cash Picks, are riding near-perfect streaks, while others like Steve Janus and Marc Lyle are winning with elite efficiency. Still others, such as Frank Sawyer and Matt Fargo, thrive by staying disciplined and grinding out consistent returns. For sports bettors—from beginners learning bankroll discipline to veterans seeking ROI optimization—this ranking provides a snapshot of where the smartest money is flowing. 👉 Want more? Visit PicksDepot.com for free picks and premium releases from these cappers and many more. Bet these winners at MyBookie and shop for lines at OddsLogic |

| Posted by Mike Godsey (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Mike Godsey is the lead NFL handicapper for Godspicks, featured at OffshoreInsiders.com |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Jets vs. Dolphins Monday Night Betting Preview: Frank Sawyer Targets the Total |

| Sep 28th, 2025 Monday Night Football delivers a fascinating AFC East clash as the New York Jets (0-3) head to South Beach to face the Miami Dolphins (0-3). Both teams are still searching for their first win of the 2025 NFL season, and the total is where sharp bettors may find the best edge. Veteran handicapper Frank Sawyer breaks it down with a lean to the Over 44 (-110) at Bovada. In this article, we’ll look at key betting angles, team trends, and why the Over makes sense in this primetime matchup. Whether you’re new to betting or a seasoned pro, you’ll get actionable insights here—and remember, for more free and premium picks, check out PicksDepot.com. Game Context

Both franchises enter winless, yet motivated. That desperation often produces high-variance games where scoring can outpace expectations. Why Frank Sawyer Leans Over 44 Frank Sawyer’s “Cutting Room Floor” plays highlight games that nearly made his premium card. For Monday night, he cut but still recommends the Over:

Both defenses have been leaky, and with two teams pressing for their first win, the game script points toward an aggressive offensive approach. Shop around for the best live lines at OddsLogic Betting Breakdown New York Jets

Miami Dolphins

Key Angles for Bettors

Frank Sawyer’s Streaks and Performance Frank Sawyer isn’t just another capper—his record speaks volumes:

When Sawyer identifies value on totals, it’s worth paying attention. You can follow his premium plays directly at PicksDepot.com. Final Word: Bet the Over With both teams desperate, defenses overexposed, and primetime pressure on, this game sets up perfectly for a higher-scoring affair. NFL free picks Jets vs. Dolphins Over 44 (-110) has enough supporting data to merit serious consideration for your Monday night card. Where to Get More Winning Picks For exclusive free picks and premium bets across NFL, NBA, college football, MLB, and more, visit PicksDepot.com. Join thousands of bettors who are taking advantage of professional insights to grow their bankroll.

|

| Posted by Shea Matthews (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Panthers vs. Patriots Betting Preview: Why Mike Lundin is Rolling with Free Bet |

| Sep 28th, 2025 The Carolina Panthers will travel to Foxborough on Sunday, September 28, 2025, at 1:00 PM ET to face the New England Patriots in an early afternoon showdown. With the Patriots listed as 5.5-point favorites, respected handicapper Mike Lundin sees value on the underdog Panthers. His NFL free pick is locked in: Carolina +5.5 (-108 at MyBookie). In this article, we’ll break down Lundin’s reasoning, analyze the betting spot, and show why following experts like him can help bettors—from casual players to sharp investors—make smarter, more profitable wagers. Free Pick Breakdown: Panthers +5.5 Mike Lundin’s picks case for backing Carolina is grounded in momentum and situational awareness.

Bottom line: Carolina is undervalued, and New England is overvalued. The Panthers are the smarter side of the wager. About Mike Lundin Mike Lundin has built his reputation on finding edges where oddsmakers overreact. Known for blending statistical models with situational betting angles, he has consistently delivered profitable results across sports. NFL free picks from him and others at PicksDepot.com

|

| Posted by Shea Matthews (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Panthers vs. Patriots Betting Preview: Why Rob Vinciletti is Taking This ATS Bet |

| Sep 28th, 2025 The Carolina Panthers face off against the New England Patriots on Sunday, September 28, 2025, at 1:00 PM ET, and the matchup offers sharp bettors a chance to grab value. Veteran handicapper Rob Vinciletti has released his free play for this contest: Carolina Panthers +5.5 (-108 at MyBookie). This article breaks down the betting angle, provides context for both teams, and highlights why Vinciletti is one of the most respected names in the sports betting world. He has one of many NFL free picks for today. Free Pick Analysis: Panthers +5.5 Rob Vinciletti’s selection is rooted in both statistical trends and situational handicapping.

For those newer to betting, this is an example of how handicappers use historical systems and situational angles to find edges that aren’t obvious to the casual bettor. About Rob Vinciletti Rob Vinciletti has been a mainstay in the handicapping world for years, blending statistical modeling with situational betting systems to deliver consistent profits. His daily cards are known for featuring exclusive betting angles, system plays, and cross-sport coverage that go beyond the basics. On this Sunday card, Vinciletti isn’t just giving out a free pick. He’s backing it up with:

It’s this kind of variety and depth that separates Rob from other handicappers. Premium Picks for Sunday While the Panthers +5.5 is a solid bankroll-friendly free pick, the real profit comes from Rob Vinciletti’s premium selections. With a blend of NFL, MLB, and WNBA, this card offers something for every bettor. 👉 You can access Rob Vinciletti’s free and premium picks right now at PicksDepot.com. Final Thoughts The Patriots may be at home, but this matchup lines up well for the Panthers, both from a statistical system standpoint and a motivational perspective. With a perfect 17-0 Week 4 trend backing them and New England struggling to convert drives into points, Carolina +5.5 holds strong betting value. ✅ Free Play: Carolina Panthers +5.5 vs. New England Patriots

|

| Posted by Shea Matthews (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Saints vs. Bills Betting Preview: Handicapper John Martin NFL Pick Free |

| Sep 28th, 2025 The New Orleans Saints head into Orchard Park on Sunday, September 28, 2025, at 1:00 PM ET to face the Buffalo Bills. Oddsmakers have set the line at Saints +15.5 (-108 at MyBookie), and respected handicapper John Martin has released his free play on this matchup. For sports bettors—whether you’re a novice just learning point spreads or a seasoned veteran seeking value in every number—this is a great case study in finding opportunity in lopsided lines. Free Pick Analysis: Saints +15.5 At first glance, the spread looks daunting. Buffalo has stormed out to a 3-0 record with two division wins and a road victory against the Ravens. However, John Martin sees this as the perfect spot to fade the favorite.

This isn’t about picking an outright upset. It’s about understanding context and recognizing that a +15.5 number offers cushion in a spot where Buffalo has little incentive to run up the score. About John Martin Handicapper John Martin is not just another capper tossing out free plays—he’s one of the most consistent names in the sports betting industry.

Currently ranked as the #6 Football Capper All-Time and #9 NFL Capper All-Time on this network, Martin’s resume speaks for itself. His ability to balance short-term opportunities with long-term profit strategies makes him a trusted source for bettors of all levels. Premium NFL Picks While free plays like Saints +15.5 provide excellent bankroll-friendly wagers, John Martin’s premium selections deliver his highest-rated insights. For Week 4, Martin is offering his Sunday All-Inclusive NFL 5-Pack for $49.99. This powerful lineup features:

And the best part? The package comes with a Guaranteed Profit—if Martin doesn’t deliver a winning Sunday, you’ll receive his Monday NFL plays free of charge. 👉 You can access John Martin’s full card and premium plays at PicksDepot.com. Final Thoughts The Bills may be the better team on paper, but betting isn’t about backing the obvious—it’s about finding value. With the line inflated to more than two touchdowns, and with Buffalo’s injury issues on defense, the Saints +15.5 becomes an attractive wager. ✅ Free Play: New Orleans Saints +15.5 vs. Buffalo Bills

|

| Posted by Shea Matthews (PicksDepot.com) (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Bears vs. Raiders Betting Preview: Why Jack Jones is Backing An ATS Pick |

| Sep 28th, 2025 When the Chicago Bears travel to face the Las Vegas Raiders on Sunday, September 28, 2025, at 4:25 PM ET, bettors will have their eyes on a game that could shape the early-season narrative for both franchises. Expert handicapper Jack Jones has weighed in with his free NFL pick: Raiders PK (-108). Bet now at MyBookie This article breaks down the matchup, explains why the Raiders hold value, and highlights why following a seasoned handicapper like Jack Jones can be the difference between casual betting and sustained profit. Raiders PK: The Case for Las Vegas The Raiders enter this matchup at 1-2, but their two losses came against elite competition—the Chargers and the Commanders. In Week 1, Las Vegas showed grit by knocking off the Patriots in Foxborough, and now they get a step down in class against a shaky Bears team. Chicago’s season has been erratic:

The Cowboys came in battered, then lost CeeDee Lamb early, crippling their offense. Add in the fact that Dallas’ defense is among the league’s weakest, and Chicago’s “statement win” looks far less impressive. Why the Bears are Vulnerable Chicago’s roster is thin and injury-plagued:

This leaves glaring holes at every level, giving Las Vegas multiple paths to exploit. Why the Raiders Have the Edge Unlike Chicago, the Raiders are healthy—backup TE Michael Mayer is the only name of concern. QB Geno Smithshould thrive against a defense allowing 31.0 points per game and an alarming 6.9 yards per play. Motivation also plays a role here. After consecutive losses, expect a focused, disciplined Raiders squad determined to bounce back at home. The betting value clearly tilts toward Las Vegas. About Jack Jones When it comes to long-term profitability, few names carry more weight than Jack Jones premium picks.

Jones’ track record shows why he’s trusted by both seasoned sharps and newcomers to the betting world. His free picks give bettors a taste of his strategy, but his premium selections are where the real profit lies. Premium NFL Picks: Sunday’s 7-Play Power Pack For Sunday, Jack Jones is rolling out an NFL 7-Play Power Pack for just $69.95. This includes:

Buying these individually would cost more than $260, but the bundle saves you $190. Even better, it comes with Jack’s profit guarantee—if he doesn’t win, you get Monday’s NFL plays free. 👉 Access Jack Jones’ free and premium picks now at PicksDepot.com. Final Word The Bears may be coming off a win, but the underlying numbers and roster concerns suggest regression is coming. The Raiders PK offers strong value in a bounce-back spot, and Jack Jones is backing Las Vegas to deliver on Sunday. ✅ Free Play: Raiders PK vs. Bears

|

| Posted by Elton Maloney (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Advisor to Joe Duffy's Picks as far as organic handicapping. An expert on matchups and other statistical analysis and research. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

Eagles vs. Bucs Betting Preview: Razor Ray Monohan Pick |

| Sep 28th, 2025 The NFL Week 4 slate brings us a heavyweight matchup between the Philadelphia Eagles and the Tampa Bay Buccaneers. Kickoff is scheduled for Sunday, September 28, 2025, at 1:00 PM ET, and this game carries plenty of intrigue for bettors. Veteran handicapper Ray Monohan has locked in on this one with a free play that’s worth your attention: Tampa Bay +3.5 at PlayMGM. For those looking to blend smart betting strategies with expert insights, this breakdown covers what you need to know about this contest—whether you’re a beginner just learning the ropes or a seasoned sports bettor chasing consistent profits. Why the Bucs +3.5 Makes Sense The Buccaneers enter this clash at 3-0, fueled by the steady leadership of Baker Mayfield, who continues to deliver late-game heroics. While Philadelphia’s roster is stacked with talent, Tampa Bay has shown the physicality and toughness to match up against the Eagles on both sides of the ball.

Money Management: The Silent Key to Betting Success Ray Monohan emphasizes something that all bettors—new and experienced—should remember: money management is everything. Free plays like this one are intended as bankroll-friendly bets, while larger premium plays carry higher stakes. The point is simple: That principle is the difference between long-term profit and short-term frustration. You’ll see professional handicappers repeat this theme again and again because it’s the foundation of winning sports betting. Meet Ray “Razor” Monohan Ray Monohan is a proven name in the sports betting industry, consistently ranking as a Top 10 Capper on every major network where his picks are offered. His calling card? CONSISTENT PROFITS. As he likes to say: “Pad that bankroll one day at a time, folks!” Clients are cashing tickets, and the Razor’s leaderboard climbs higher each week. Free plays like this Bucs +3.5 pick showcase his sharp eye, but his premium picks are where he brings the heavy firepower. 🔗 You can grab all of Ray Monohan’s picks free and premium plays right now at PicksDepot.com. Free vs. Premium Picks: Know the Difference

Smart bettors use both strategically. Free plays help you stay engaged, while premium plays are the core profit-drivers in your portfolio. Final Thoughts: Buccaneers Worth the Bet The Eagles may have the name recognition, but the Bucs +3.5 line holds real value this week. With Mayfield’s late-game magic, Tampa Bay’s improved defense, and the situational factors pointing toward a tight contest, this free pick from Ray Monohan is backed by logic and momentum. But don’t stop at free picks. If you’re serious about turning betting into a consistent revenue stream, make sure you’re investing in premium insights from trusted handicappers. 👉 Visit PicksDepot.com today for Ray Monohan’s full card of NFL, college football, and more. ✅ Free Play: Buccaneers +3.5 vs. Eagles Because in sports betting, the difference between guessing and winning is following the right people. Would you like me to also create a shorter social-media-ready version (X/Instagram post format) that teases the free pick and pushes readers to PicksDepot for the premium plays?

|

| Posted by Kal Elner (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Kal Elner is widely recognized as a leading expert in MLB betting, consistently demonstrating an exceptional ability to dissect and leverage game dynamics to produce profitable outcomes. His specialization extends deeply into the nuanced realms of small conference college basketball and college football, areas often overlooked by other handicappers but rich with wagering opportunities. This specialized knowledge has consistently provided bettors with a distinct edge. Elner's standout reputation is further amplified by his unrivaled expertise in All-Star Game betting across multiple sports, where his unique insights and analytical prowess consistently deliver unmatched results. His proven track record in these high-profile events has solidified his status as the premier All-Star Game handicapper in the industry. Additionally, Kal Elner lends his strategic expertise as a trusted advisor to OffshoreInsiders.com, further testament to his credibility and the high regard in which his analysis and handicapping acumen are held among industry professionals and seasoned bettors alike. |

| There are no comments for this article |

|

The Trackback URL for this article is: |

NFL Week 4 Betting Preview: Ravens vs Chiefs Pick from Joseph D’Amico |

| Sep 28th, 2025 When two of the NFL’s most talked-about franchises clash, bettors pay attention. This Sunday afternoon (4:25 PM EST), the Baltimore Ravens travel to Arrowhead Stadium to take on the Kansas City Chiefs in a game that has both betting and playoff implications. Top handicapper Joseph D’Amico has released his free winner on this matchup, and as always, he blends decades of experience with sharp market analysis. Below, we break down the game and his reasoning so you can approach this contest with confidence. Ravens vs Chiefs: The Matchup

On paper, Kansas City has history on their side. The Chiefs have typically dominated the Ravens in recent meetings, they are playing at home, and they’re coming off their first win of the season. However, as Joseph D’Amico points out, football isn’t played on paper—it’s played on the gridiron. Why Joseph D’Amico Likes the Ravens D’Amico’s free selection for Sunday is Baltimore Ravens -145, and here’s why:

What This Means for Sports Bettors For beginner bettors, the lesson here is that matchups aren’t decided by surface stats alone. Looking deeper at offensive efficiency, scoring consistency, and situational dynamics can give you the edge. For intermediate bettors, note how D’Amico weighs long-term data (Chiefs’ struggles at 20 PPG) against recent form (Ravens’ ability to remain competitive). This is the type of layered analysis you should emulate when breaking down any NFL slate. For expert bettors, this game is a case study in market perception. On paper, Kansas City “should” be the side—home, history, recent win. But the sharper angle lies in recognizing that the line bakes in those assumptions, leaving Baltimore with true value at -145. Joseph D’Amico’s Premium Picks While the Ravens vs Chiefs game is his Sunday FREE WINNER, Joseph D’Amico also has a loaded card featuring:

If you’re serious about cashing in on the NFL board, check out Joseph D’Amico’s premium picks. His decades of success, from Las Vegas to the online marketplace, have made him one of the most trusted names in sports handicapping. Final Takeaway The Ravens vs Chiefs matchup is more than just another Week 4 game—it’s a chance to apply sharp betting principles. Don’t get swayed by historical dominance or home-field narratives alone. As Joseph D’Amico stresses, the Ravens’ offensive edge and Kansas City’s inconsistency point strongly toward Baltimore -145 as the right side. Whether you’re new to sports betting or a seasoned player looking for an edge, learning from top handicappers like D’Amico is one of the fastest ways to elevate your game. Ready to cash in? Grab his premium plays at PicksDepot.com and follow a true professional all the way to the bank. |

| Posted by Elton Maloney (Profile) | Permalink | Comments (0) | Trackbacks (0) |

| Advisor to Joe Duffy's Picks as far as organic handicapping. An expert on matchups and other statistical analysis and research. |

| There are no comments for this article |

|

The Trackback URL for this article is: |